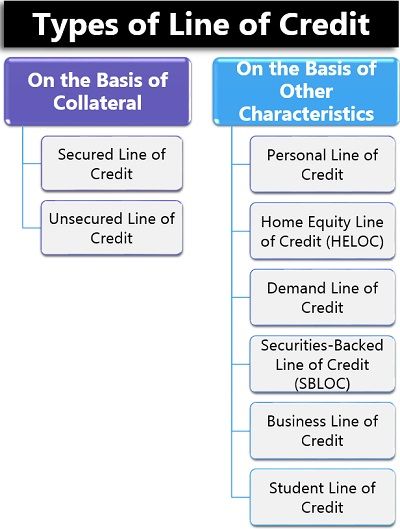

This type of loan is backed by securities held in a portfolio so the cash needs are satisfied without disrupting investments investment strategies and asset allocation or creating unexpected tax consequences.

Securities backed line of credit definition.

An increasing number of securities firms are marketing and offering securities backed lines of credit or sblocs to investors.

These kinds of loans are generally offered to high net worth.

Definition of securities backed lines of credit.

Some broker dealers allow customers to have a line of credit attached to their account which allows the investor to borrow funds based on the value of the fully paid for assets in the account.

Firms market sblocs as a type of financing and liquidity strategy.

Firms market sblocs as a type of financing and liquidity strategy.

Securities backed lines of credit sblocs are extremely risky for the everyday investor.

Sblocs can be a key revenue source for securities firms especially in times of solid market returns and growing investment portfolios when investors may feel more comfortable leveraging their assets.

Sblocs can be a key revenue source for securities firms especially in times of solid market returns and growing investment portfolios when investors may feel more comfortable leveraging their assets.

The price of securities are constantly shifting which means that the collateral backing the line of credit may also be volatile.

Sblocs are extremely risky.

Securities based lending provides capital to help people buy real estate to purchase personal property or to invest in a business.

Securities backed line of credit if you already own stocks and bonds you can leverage them to secure a securities backed line of credit.

:max_bytes(150000):strip_icc()/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

:max_bytes(150000):strip_icc()/td-bank-inv-e03bbc3fe81c4dbfa388c9fe2ccd3876.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Why_do_MBS_mortgage-backed_securities_still_exist_if_they_created_so_much_trouble_in_2008_Apr_2020-01-fb17668872fd483781eef521a1ddbde8.jpg)

:max_bytes(150000):strip_icc()/AnIntroductiontoStructuredProducts1-1a2eea05ef064d3fae32c8e1de618eaa.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Risk_Feb_2020-01-66f3c5ffb3c040848f1708091fa40eb9.jpg)

:max_bytes(150000):strip_icc()/AchieveOptimalAssetAllocation-03_2-fd04b9b6304943548dfbff345f920cda.png)

:max_bytes(150000):strip_icc()/MunicipalBondTipsfortheSeries7Exam3-0172a9bddeea4d0f9ab3426044d08b6a.png)